News

Incorp International

Incorp International

2024-10-22 09:15

2024-10-22 09:15

Hong Kong stands at the forefront of the biotechnology, medical, and healthcare sectors, pivotal in the region’s economy. With significant demographic shifts, Hong Kong’s healthcare industry is positioned for substantial growth, fueled by government initiatives and technological advancements.

This article explores the Hong Kong biotechnology, medical and healthcare landscape, as well as its key statistics, trends and highlights the opportunities for investors and startups.

Market Overview

Demographics and Health Trends

Hong Kong’s population is ageing rapidly. By 2034, over 30% of residents will be aged 65 or above. This demographic shift underscores the need for advanced healthcare services and innovative medical solutions. Additionally, consumers’ health consciousness is growing, leading to increased demand for preventive and personalised healthcare.

Healthcare Expenditure

The ageing population and rising consumer health consciousness drive the increased demand for healthcare services and products. The Food and Health Bureau reports that in 2021-22, Hong Kong’s total health expenditure, encompassing both public and private sectors, reached approximately HK$243.2 billion (US$31.2 billion), accounting for 8.5% of the GDP.

Sector Analysis

Medical & Healthcare Devices

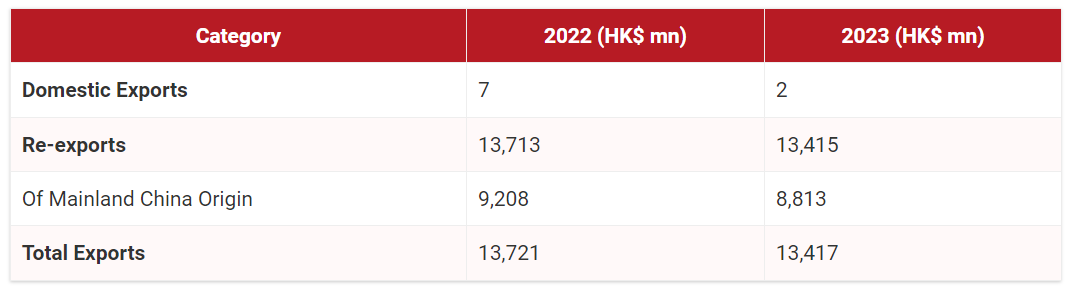

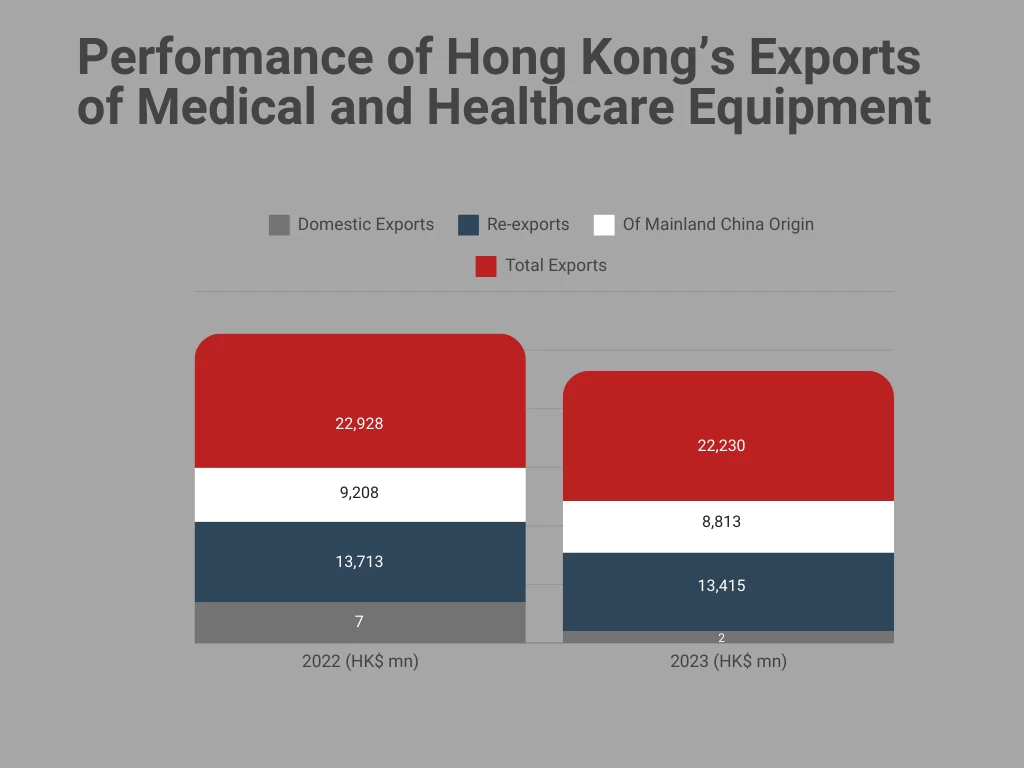

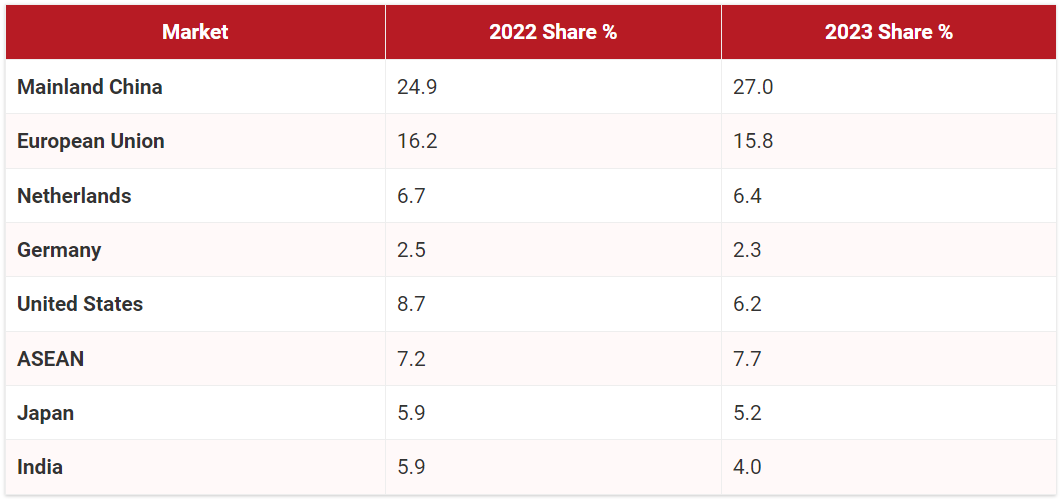

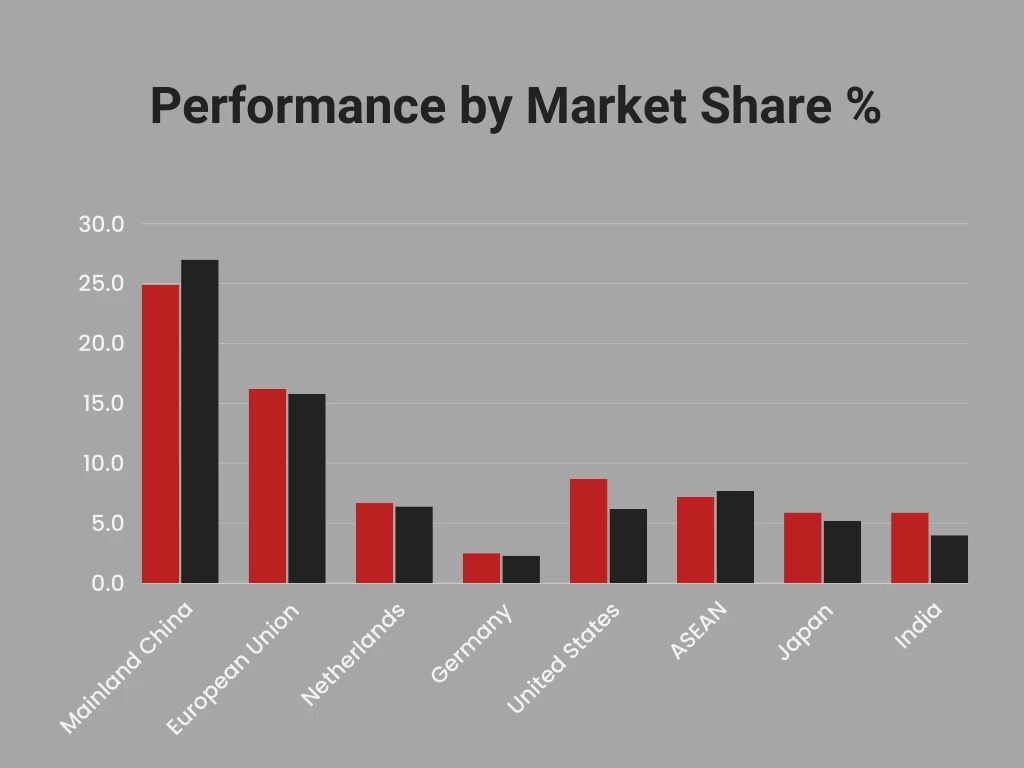

The medical and healthcare devices market in Hong Kong is segmented into household consumers and professional/institutional buyers. Key product categories include diagnostic equipment, therapeutic devices, and health monitoring tools. The export performance of medical devices remains strong, with significant growth in domestic and re-exports to major markets like the United States and China.

Performance of Hong Kong’s Exports of Medical and Healthcare Equipment

Performance by Market

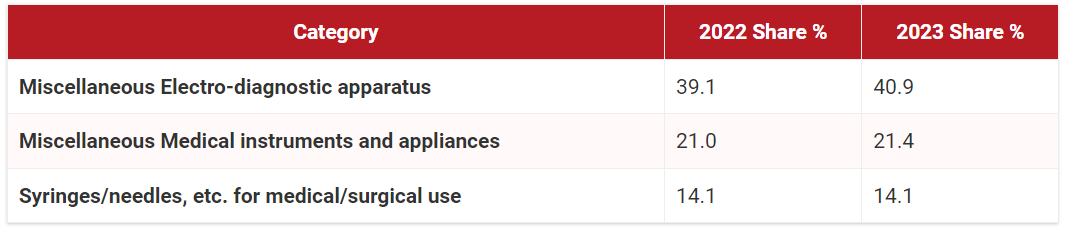

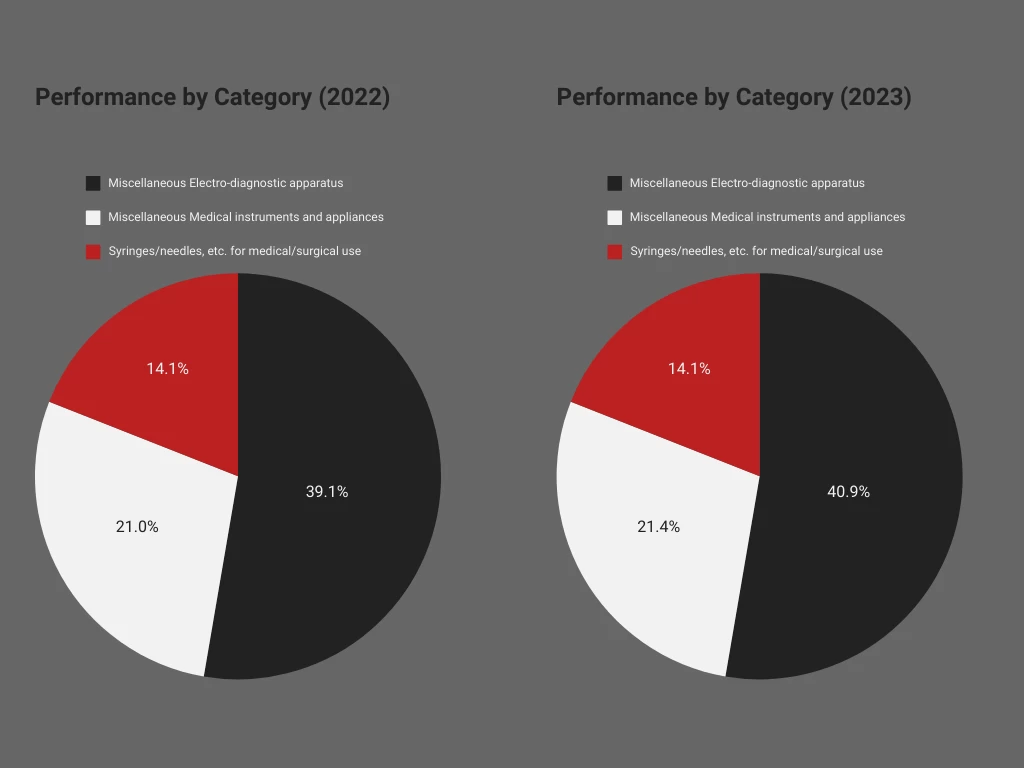

Performance by Category

Medical Services

Hong Kong’s medical services sector comprises public and private institutions. The ageing population and technological advancements, such as smart hospitals and telehealth, drive demand for medical services. These innovations are enhancing patient care and operational efficiency.

Biotechnology Sector

Industry Composition

Hong Kong’s biotechnology sector encompasses diverse companies focused on pharmaceuticals, traditional Chinese medicine, and medical devices. The industry is supported by organisations like the Hong Kong Science and Technology Parks Corporation (HKSTP), which fosters innovation and collaboration.

Support and Innovation

The Biomedical Technology (BMT) Cluster, established by HKSTP, is crucial in driving innovation. It provides state-of-the-art facilities and support for biotech startups, promoting research and development in the sector.

Healthcare Innovations

Technological Developments

Telehealth: Telehealth adoption is proliferating, with major platforms offering guidelines and services for remote consultations and patient monitoring.

3D Printing: Applications in healthcare include custom prosthetics, surgical instruments, and bioprinting of tissues.

Robotics: Key developments include surgical robots, rehabilitation robots, and automated medication dispensing systems.

Virtual Reality (VR): Uses inpatient rehabilitation and medical training are expanding, providing immersive and practical solutions.

Biosensors and Trackers: Wearable technology for health monitoring is becoming increasingly popular, enabling real-time data collection and analysis.

Government Initiatives

Key Policies and Schemes

The Hong Kong government is committed to supporting innovation through policies and schemes like the InnoLife Healthtech Hub and the New Industrialisation Acceleration Scheme. These initiatives provide funding, resources, and infrastructure to foster growth in the biotech and healthcare sectors.

Significant Events of 2024

Key trade fairs, conferences, and exhibitions in 2024 will offer valuable market exploration and networking opportunities. Events like the Asia Biotech Invest and the Hong Kong International Medical Devices and Supplies Fair are must-attend for industry professionals.

Hong Kong’s Strategic Advantages

Market Connections with Mainland China

Hong Kong’s integration with the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) provides significant market opportunities. The approval and use of Hong Kong-registered drugs and medical devices in the GBA facilitate seamless market access.

R&D Hub for Health Innovations

Hong Kong boasts world-class research capabilities and facilities. Partnerships with international research institutions enhance the city’s reputation as a leading R&D hub for health innovations.

Fundraising Hub for Biotechnology

Hong Kong is a premier destination for biotech IPOs, supported by a favourable listing regime and government financial backing. The city’s strategic location and robust financial infrastructure make it an ideal hub for biotech fundraising.

CEPA Benefits

The Closer Economic Partnership Arrangement (CEPA) offers zero tariffs for Hong Kong-origin products and provides flexibility for Hong Kong service suppliers in the mainland healthcare market. These benefits enhance Hong Kong’s competitive edge in the region.

Contact Us

Contact Us